Streamlining Excise Reporting: Save Time, Stay Compliant

Spend less time on spreadsheets and more time on spirits—automate your excise compliance with Liquor Logic.

Staying compliant with excise duty laws is non-negotiable for distilleries—but that doesn’t mean it should consume your entire admin day. Manual tracking, spreadsheets, and cross-checking volumes with duty rates can lead to errors, delays, and even penalties.

Why Excise Compliance Matters

Whether you’re in South Africa, Australia, or the UK, alcohol producers must track bonded stock, report accurate volumes, and pay excise correctly. One mistake could mean fines, backdated payments, or reputational damage that’s hard to reverse.

Here’s why proper compliance is critical:

- Legal obligation: Noncompliance can lead to heavy fines or shutdowns

- Audit readiness: You must prove that what you produced, stored, and sold aligns with your duty returns

- Financial planning: Excise is a huge cost—mistakes here hit your margins

How Software Simplifies It

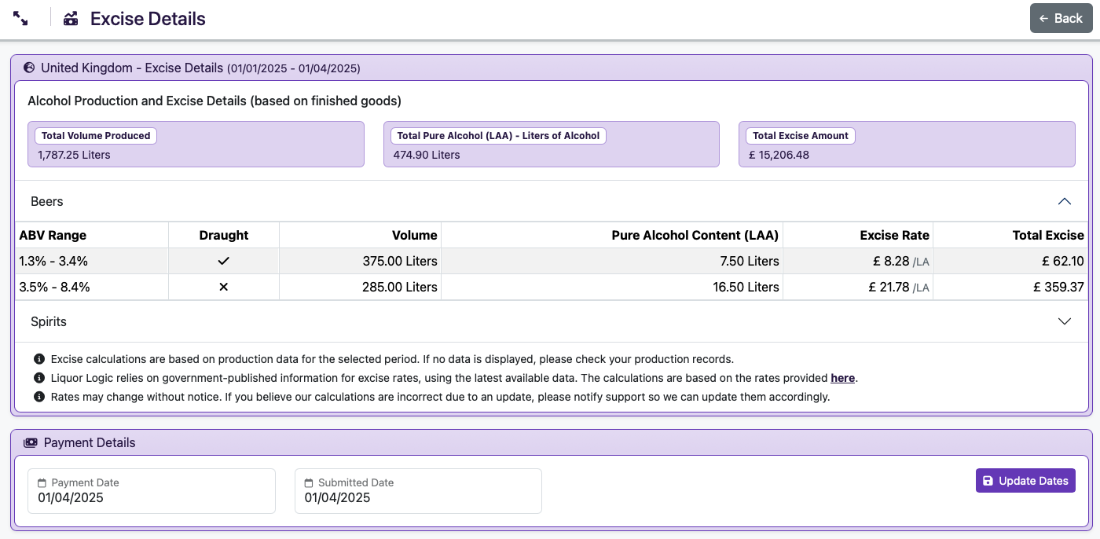

Liquor Logic automates excise management by integrating directly with your production and inventory workflows. That means no double entry, no guessing—and real-time, ABV-driven tax data ready when you need it.

Liquor Logic tracks and compiles:

- Production volumes by product, category, and alcohol percentage

- Bonded vs non-bonded movement and opening/closing balances

- Applicable excise rates per AA or volume per country

- Regulatory reporting structures by region (monthly, quarterly, etc.)

Country-Specific Compliance

Excise systems vary dramatically by country. Liquor Logic handles key regulatory models, including:

- South Africa (SARS) – Excise per litre of absolute alcohol, monthly returns

- Australia (ATO) – Excise based on product type, strength, and volume, with up-to-date rates

- United Kingdom (HMRC) – New 2023 system based on strength bands; rolling compliance updates supported

Each jurisdiction comes with unique duty rules, claim procedures (e.g., production losses, reworks), and reporting forms. Liquor Logic accounts for all of these so you stay compliant without having to become a tax expert.

Eliminate Human Error

When excise is calculated automatically from your production data, there’s no more retyping, no more missed litres, and far less risk. Reports are generated in one click— accurate, compliant, and ready to submit.

- Built-in tolerance checks for variances

- Support for multi-location bonded facilities

- Auto-conversion between unit systems (litres, AAs, bulk litres)

- Digital archiving of past reports for audit traceability

Conclusion

Excise duty doesn’t have to be a headache. With Liquor Logic, you can streamline compliance, reduce admin time, and avoid costly errors—so you can get back to focusing on great spirits.

Bonus: When regulations change—like HMRC’s updates in 2023 or SARS’s duty

increases—Liquor Logic updates your settings automatically. Compliance isn’t just easier—it’s proactive.

Back